Everything Importers Should Know About Customs Clearance UK

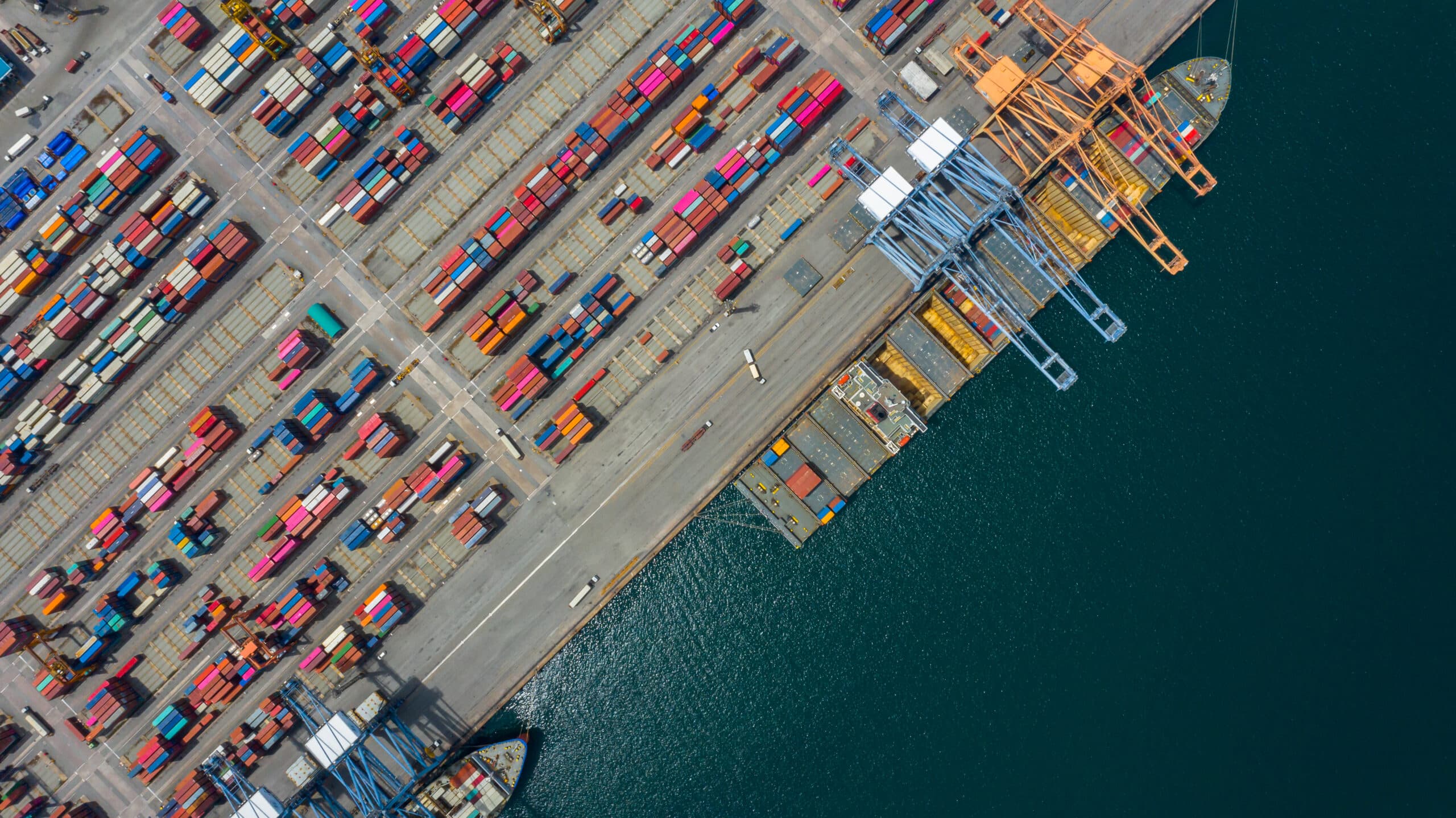

Importing goods into the United Kingdom can open exciting opportunities for businesses, but it also comes with responsibilities that should never be overlooked. One of the most critical steps is Customs Clearance UK—a process that ensures shipments comply with UK laws and are properly documented before entering the market. Understanding how this works can save you time, reduce costs, and help your products move smoothly through ports and borders.

What Is Customs Clearance?

Customs clearance is the procedure of preparing and submitting the necessary documentation to enable goods to enter a country legally. In the UK, this involves declaring the shipment to HM Revenue & Customs (HMRC), paying any applicable duties or VAT, and confirming that the products meet the country’s import regulations. Without proper clearance, goods can be delayed, seized, or returned to the sender.

Why Customs Clearance Matters for Importers

For importers, customs clearance is more than a legal requirement—it’s a crucial step in maintaining supply chain efficiency. Delays at the border can disrupt business schedules, increase storage fees, and damage customer relationships. A thorough understanding of Customs Clearance UK procedures helps ensure compliance and keeps your operations running without unnecessary interruptions.

Key Documents You’ll Need

Successful customs clearance depends on accurate paperwork. The most common documents include:

- Commercial Invoice: Provides details about the seller, buyer, goods description, and value.

- Packing List: Specifies how the goods are packaged and their weight or dimensions.

- Bill of Lading or Air Waybill: Acts as a contract between the shipper and carrier.

- Customs Declaration: Lists shipment information for HMRC processing.

- Certificates or Licences: Certain goods, such as food or chemicals, require special permits.

Having these documents complete and error-free is essential. Even minor mistakes can lead to delays or additional inspections.

Understanding Duties and Taxes

All imported goods are subject to assessment by HMRC. Import duties vary depending on the product type, origin, and trade agreements in place. VAT is also applied to most imports. Importers should research applicable tariffs and factor them into their cost calculations. Post-Brexit, goods moving between the UK and the EU require customs declarations, making it vital to stay updated on current regulations.

Common Challenges in Customs Clearance

Despite preparation, importers often face obstacles such as:

- Incomplete or inaccurate paperwork

- Incorrect classification of goods

- Unexpected duty rates or VAT

- Restricted or prohibited items

- Delays caused by security or compliance checks

Mitigating these challenges involves working with experienced professionals, ensuring documentation is correct, and keeping track of any updates to UK trade rules.

How to Streamline the Process

Efficient customs clearance begins with planning. Here are some practical tips:

- Know Your Goods: Classify your products correctly using the UK Trade Tariff.

- Stay Current: Monitor changes in import regulations, especially if your goods fall under special categories.

- Use a Reliable Customs Agent: These specialists can guide you through the paperwork and liaise with HMRC on your behalf.

- Plan for Delays: Build buffer time into your supply chain to accommodate unexpected checks or peak-season congestion.

- Digitise Records: Keeping electronic copies of invoices, licences, and declarations speeds up retrieval during inspections.

Partnering with Professionals

Navigating the complexities of customs on your own can be overwhelming, especially for businesses importing high volumes or specialised products. Partnering with an experienced clearance service like Global Customs UK gives you peace of mind. Their team handles everything from accurate documentation to liaising with HMRC, ensuring your goods clear the border quickly and compliantly.

The Role of Technology in Customs

Modern customs clearance increasingly relies on digital platforms. Electronic declarations, automated tariff calculation, and real-time shipment tracking simplify the process and minimise human error. Importers who invest in technology or partner with providers offering these solutions gain a competitive advantage by reducing administrative burdens and improving transparency.

Understanding customs procedures is essential for every importer operating in the UK. From preparing documents to calculating duties and taxes, each step in Customs Clearance UK affects how quickly and smoothly your goods reach their destination. With proper planning, attention to detail, and support from experienced professionals, you can make the process seamless and focus on what matters most—expanding your business opportunities.

.png&w=256&q=75)